digital account origination /commercial banking / interac upgrade

context

Subsequent to a tech upgrade, a brand upgrade, process transformation, the next phase of banking involved a few key initiatives outside of BAU features and functions

Digitizing key revenue driving products such as demand accounts, registered products (TFSA, RRSP, FHSA, ODP)

Operationalizing a migration of commercial banking users to the new refreshed platform

Upgrading the Interac back-end and consequently the front end that went with it

Year

2023

Role

Director, UX

Non Interest Income & Revenue Generation

Goal

Enable multi user and multi transaction capabilities while working on individual projects and ensuring a seamless experience across each capability while also driving BAU

Challenge

These capabilities were being implemented on a single code base by individual project teams and designers along different timelines in the same fiscal year.

Implementing a unified visual expression across differing functions, priorities and user groups bound very tightly by technical limits

Optimizing design implementations to ensure minimal impact to development and maximum value to the member.

Themes

Commercial Banking Tech Migration

Interac Back End and Front End Upgrade

approach

Prior re-brand helped gather a clear understanding on underlying front end code and clearing up design debt and auditing for better accessibility - page templates, components, styling options were understood and catalogued.

The technology decision was to leverage the existing code base from personal banking for a commercial audience to optimize speed to market and contain costs. The commercial audience however has different priorities, very different data generated and to be utilized.

Digitization of personal banking products meant introduction of newer and differing templates, layouts as the expression of the brand grew.

Interac upgrade from both a technology and front end perspective meant introducing new capabilities to members and ensuring that the newer templates did not present any design conflicts - especially since these would be used more frequently and hence more memorable to the member.

Given the time frame of these projects - they were worked on by different designers and project teams and even a split between agile squads and waterfall releases.

commercial banking

personal banking

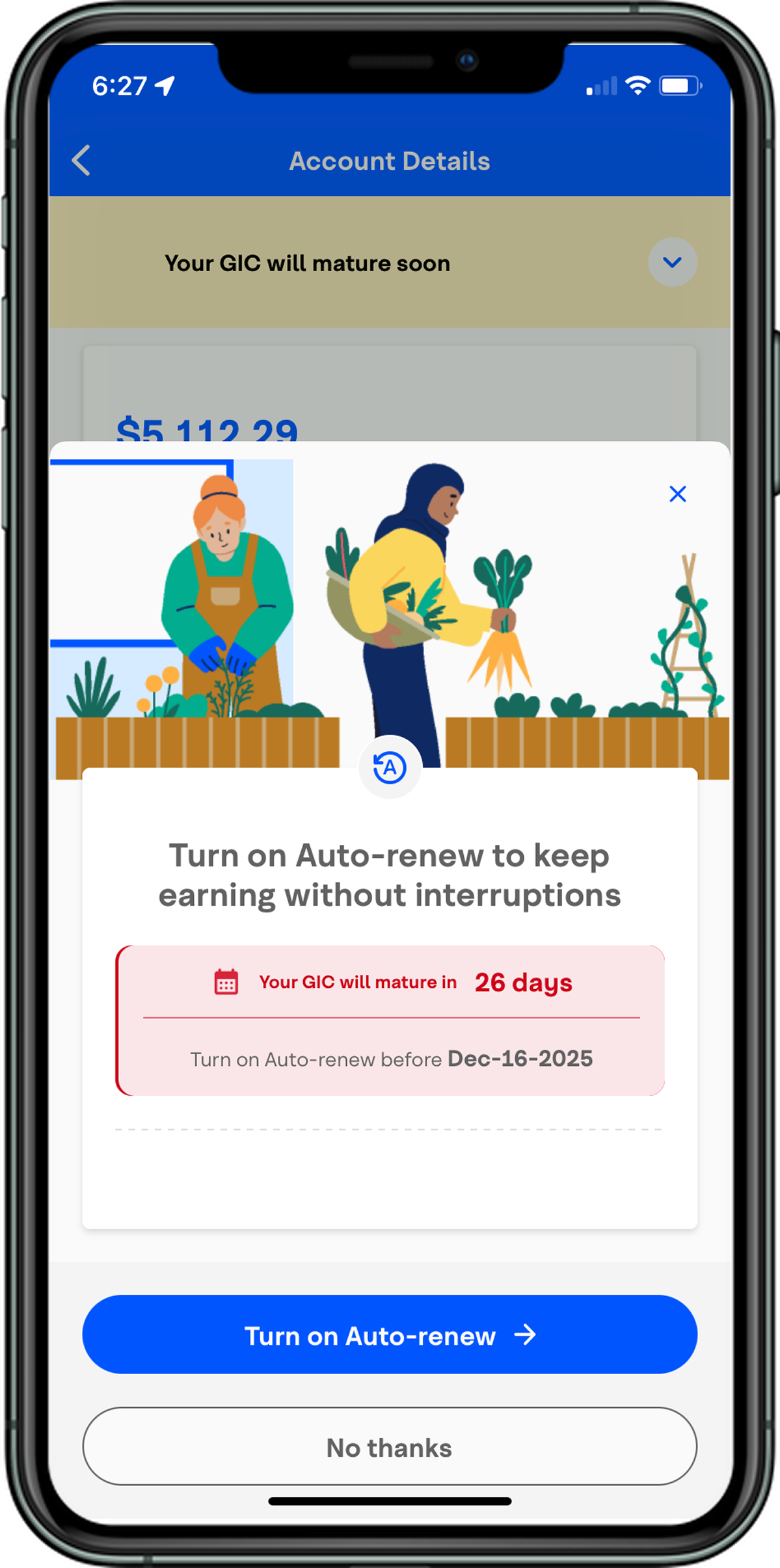

From a personal banking context, new templates were introduced to allow for complex products such as registered products guiding the member through multi step execution while also bringing in the aspect of financial education and self sufficiency.

interac banking

Interac

BAU

These were tested and iterated upon with each differing product released through agile sprints. These templates were reconciled with any symbiotic data representation for commercial users.

From a commercial context commonality in function and form were identified and isolated - specific data layouts and transactions were identified, designed and tested by end users. A family of components used in a similar context were created and a brand aesthetic specific to the commercial context was identified and cultivated.

Deployment of this aesthetic was galvanized by the design system established prior, allowing for theming and other variants

Commercial

Lastly for the interac upgrade, prior discovery research and concepts had been conducted and shared with the vendor that supported their development of the core product. This simplified in large parts the implementation of the function and provided comfort on key decisions made.

From a process perspective, to ensure the team delivered on both design and outcomes, I took the following steps

Regular crits/ collaboration and share outs to ensure clear liens of visibility on status/progress/choices and impacts.

Multiple check ins with development and QA team to drive visibility into dependency and value delivered by each design recommendations

Continuous rationalizing of member choices from a compliance, legal, marketing and consumer protection perspective to validate that while needs were being met, the member was being supported in making informed choices.

outcome

The digital squad released functionality at regular sprints and release for the duration. This cycle allowed me to reconcile any gaps that were missed during the other two projects especially given that the code based was ultimately shared and differences could be cascaded through style sheets and shared templates.

In planning out the delivery of both large capabilities, worked with eh development to plan out design work in sprints. This once more allowed a reasonable absorption of drift and quality throughput of design.

Ultimately was able to deliver seamless experiences to all members, launching an individual aesthetic to our commercial audience, an upgraded and refined e- transfer experience and origination of valuable revenue generating deposit, demand and registered accounts.

<15% increase

Components Added

52K users

Migrated

16%

Accounts upgraded